Taxes off paycheck

Firstly you will be served a 7-day reminder notice and at the end of this time if you still havent paid you will be paying the entire years council tax. Montana Individual Income Tax Return Form 2 2021.

Paycheck Calculator For Excel Paycheck Payroll Taxes Consumer Math

Census Bureau Number of cities that have local income taxes.

. These are the rates for. For example in the tax. Whether you owe taxes or youre expecting a refund you can find out your tax returns status by.

Start wNo Money Down 100 Back Guarantee. This is tax withholding. How Your Washington Paycheck Works.

Your bracket depends on your taxable income and filing status. Viewing your IRS account. Ad Compare Prices Find the Best Rates for Payroll Services.

Ad Make the World Your Marketplace With Aprios International Tax Planning Services Today. There are a maximum of 2. 18 hours ago3rd Round of Stimulus Payments.

17 hours agoThe income tax rebate calls for a single person to receive 50 while those who file taxes jointly are poised to receive a total of 100 Mendozas office said in a news release. Prior to 2021 Tennessee levied a flat tax on income earned from interest and dividends. If you receive employment income or any other type of income your employer or payer will deduct income tax at source from the amount paid.

Make Your Payroll Effortless and Focus on What really Matters. Too little could mean an unexpected tax bill or penalty. Taxes Paid Filed - 100 Guarantee.

From each of your paychecks 62 of your earnings is deducted for Social Security taxes which your employer matches. The changes to the tax law could affect your withholding. Taxes Paid Filed - 100 Guarantee.

New York Paycheck Quick Facts. For a single filer the first 9875 you earn is taxed at 10. Your average tax rate is 217 and your marginal tax rate is 360.

The bracket you land in depends on a variety of. 10 12 22 24 32 35 and 37. Montana Individual Income Tax Return Form 2 2020.

Individuals qualified for the full stimulus payment if their AGI. The money also grows tax-free so that you only pay income tax when you. That means that your net pay will be 43041 per year or 3587 per month.

New York income tax rate. The amount of income tax your employer withholds from your regular pay depends on two things. The amount you earn.

The third stimulus checks were based on your 2019 or 2020 tax information. Only the very last 1475 you earned. However making pre-tax contributions will also decrease the amount of your pay that is subject to income tax.

Start wNo Money Down 100 Back Guarantee. Also known as paycheck tax or payroll tax these taxes are taken from your paycheck directly and are used to fund social security and medicare. Easy To Run Payroll Get Set Up Running in Minutes.

This was called the Hall Income Tax after Sen. The information you give your employer on Form. See how your withholding affects your.

Use this tool to estimate the federal income tax you want your employer to withhold from your paycheck. Using the IRS Wheres My Refund tool. Ad Honest Fast Help - A BBB Rated.

Frank Hall the senator who. A Paycheck Checkup can help you see if youre withholding the right amount of tax from your paycheck. Withholding is the amount of income tax your employer pays on your behalf from your paycheck.

Delivering results expertise and proactive client service for International Tax Advisory. Earned income income you receive from your job s is measured against seven tax brackets ranging from 10 to 37. Ad Payroll So Easy You Can Set It Up Run It Yourself.

Ad Honest Fast Help - A BBB Rated. Know Your OptionsSpeak To One Of Our Experienced CPA IRS Enrolled Agents Now. You will need your.

You pay the tax on only the first 147000 of. Ad Guaranteed Results From A BBB Firm With 28 Years In Practice. Ad Choose Your Paycheck Tools from the Premier Resource for Businesses.

The next 30249 you earn--the amount from 9876 to 40125--is taxed at 15. There are seven federal tax brackets for the 2021 tax year. Census Bureau Number of cities that have local income taxes.

This marginal tax rate means that your immediate. Washington income tax rate.

How Much In Taxes Is Taken Out Of Your Paycheck Morningstar

Check Your Paycheck News Congressman Daniel Webster

The Measure Of A Plan

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

/Paycheck_AdobeStock_154492502_Editorial_Use_Only-b62ac70013ec4e13b3e2a73be5e9c239.jpeg)

Annual Compensation Vs Annual Salary

The Measure Of A Plan

Mathematics For Work And Everyday Life

How To Calculate Payroll Tax Deductions Monster Ca

Paycheck Calculator Online For Per Pay Period Create W 4

Here S How Much Money You Take Home From A 75 000 Salary

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

Decoding Your Paystub In 2022 Entertainment Partners

Understanding Your Paycheck Credit Com

Mathematics For Work And Everyday Life

Free Online Paycheck Calculator Calculate Take Home Pay 2022

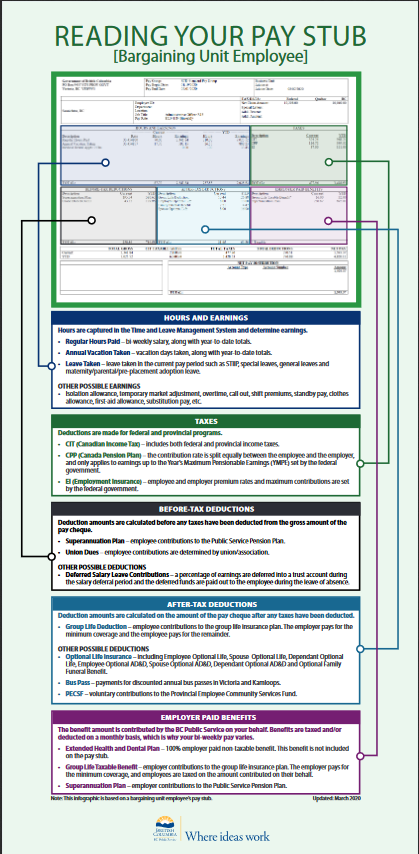

How To Read Your Pay Stub Province Of British Columbia

Paycheck Taxes Federal State Local Withholding H R Block